Central Bank Connoisseur

LLTJ

Before we carry on, I want to declare that I’m honouring this post & all my future posts to my recently passed friend, Trust - a great guy who had a bright life ahead of him with exuberant potential, and it’s only right that I pay tribute to the man that contributed to the person I’ve become & will become. This is for you, we’ll ensure your legacy goes on for generations to come!

TJ was more than a statistic, more than a figure, more than a number. He was a king that inspired us all. I know that he taught not me but also many others that success is non-negotiable. That regardless of your academic, cultural, and/or ethnic background, that we all can soar to great heights. In other words, he had that dawg in him. His name will manifest throughout all of our actions & achievements…#LLTJ🕊️❤️🔥

we all love you, god bless you brother.

Preamble

Welcome to another post of the macroman newsletter. In this issue, we’ll delve into our fx outlooks, any change in equities, & if our stance continues/changes in light of recent weakness/strength. You may feel obliged to read the following posts before continuing on with this one:

United States of America

To properly understand this, you’ll have to read the SVB article as it played quite a role in the nights leading up to the rate decision - or at least market participants exaggerate such.

What was the significance of SVB?

Everyone - or should I just say David Sacks & Bill Ackman (LOL) - became afraid that the SVB contagion may spread across regional banks & break the banking sector resulting in a financial crisis, as per '08. The FED, Americas’ Central Bank, intervened thereby insuring depositors but not creditors. Therefore, they basically bailed out SVB (ish).

Ok, I still don’t see the problem…?

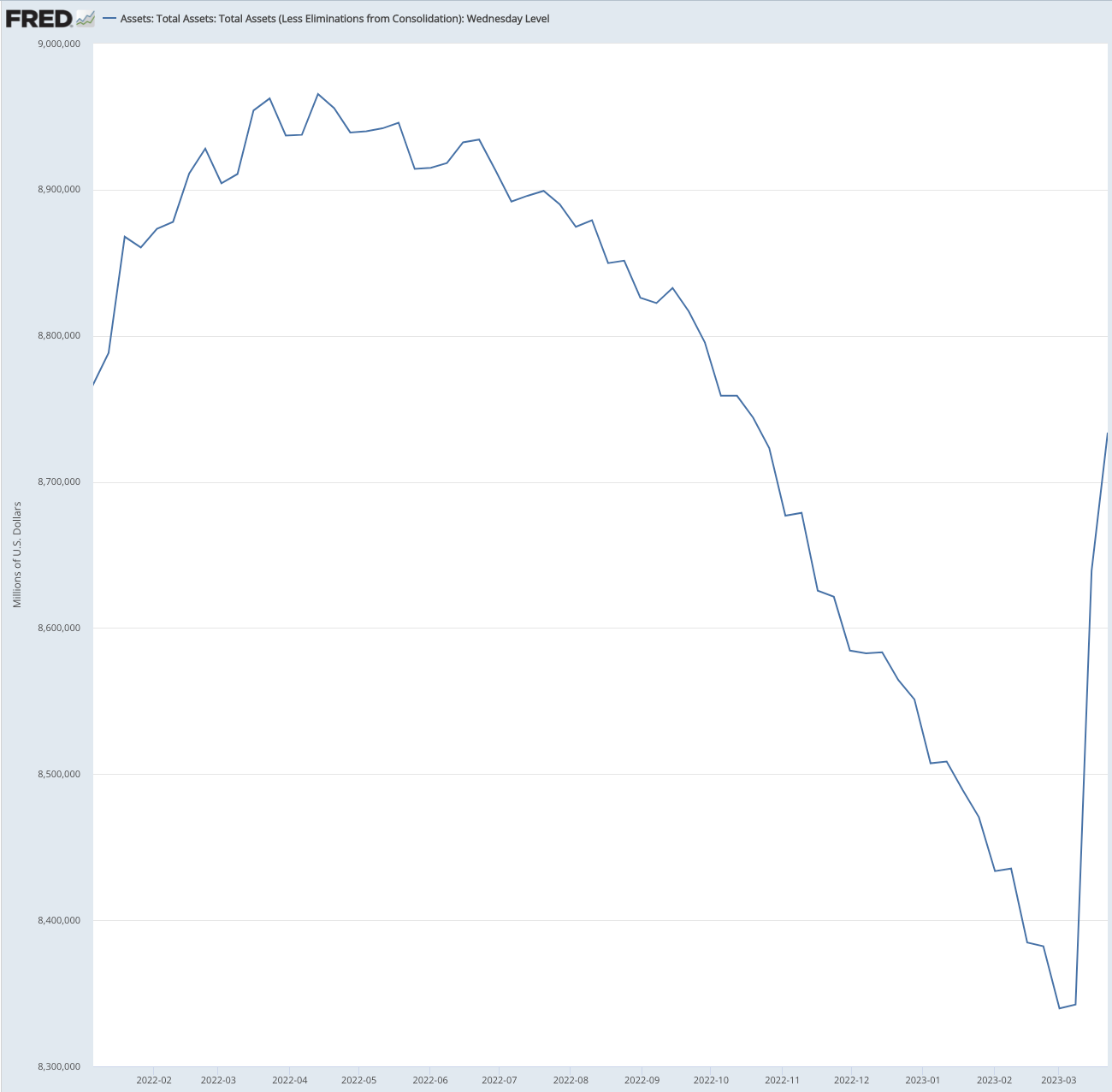

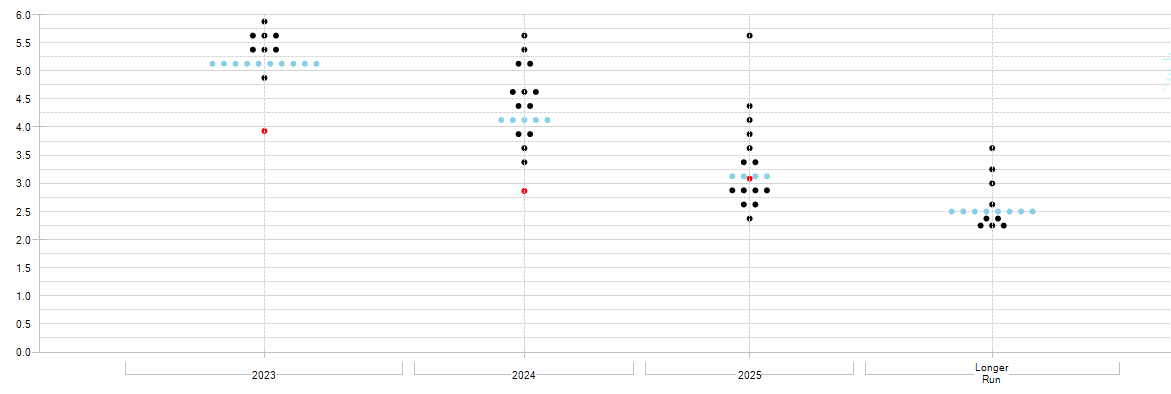

Well, as a result of these ‘bailouts’ - the FED have exponentially increased their assets (displayed on BS) in a QT regime, meaning we’re meant to reduce our assets for the betterment of the economy. There has been loads of talk on whether QE, the opposite of QT, is back. But, that’s all it is - just talk. Powell, post-FOMC, had reaffirmed that they’re not to be worried about the banking sector & moreso focused on inflation back to target. Furthermore, below is a dot-plot from the FED on rates & monetary policy, which goes to show they’re not looking to cut rates this year & IRs will remain at 5%, as a projection.

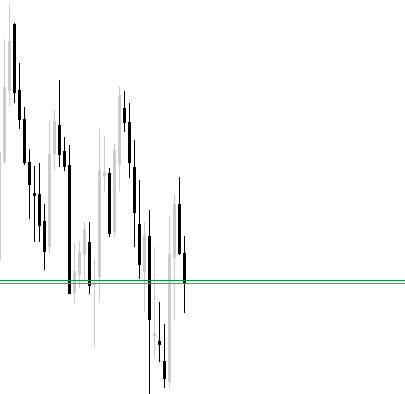

US economic data post-SVB is pretty mixed eg services doing well, mfg doing bad, retail/housing up but nothing shocking. With regards to the markets, I’m completely out of any USD longs as its had an outstanding decline amidst the banking situation pricing in a (silly) ‘pivot’ scenario.

Above is the dollar visually represented, if you’re a fan of technicals - you could state that it’s filling the gap to head higher towards the higher gap on monthly candle. That’s if you’re a believer in technicals. Unless I see a significant shift in economic data/outlook, then I’m not trading the long dollar bias yet although I do believe in it. If you want to see any change in thought, I’ll (ASAP) post it on my twtr - ElzTrades.

Summarised

QT, but lots of work demolished due to ‘banking crisis’

FED not phased by banks, no rate cuts this yr

mixed econ data, no clear view on where markets are headed next

The United Kingdom

Wow, just wow. This call has been immense, one of my greatest trades YTD! My outlook, which was quite contrarian (greater UK economy, more infl, more hikes), has been proven right. The economic data has been relatively great, in terms of the long gbp view.

The key takeaway here is that we’ve seen that inflation is sticky (10.2% to 10.4%) which fuelled a 25bps move when there was talks about a pause. Further BoE speakers have gone on to be rather hawkish, & in support of tougher hikes. Additionally, along the outstanding econ data; we’ve had the chancellor, J. Hunt, go on to reveal in his budget that our economy is improving. OECD not predicting recession anymore, GDP projections improving etc etc…

I’ve obviously took partials on this trade & took a huge lump of unrealised prof and making it realised. But, I’ll be looking to carry on adding to my position provided the market gives me the opportunity.

Summarised

Economy flourishing

Tougher infl supporting more rate hikes

On standby to add more to the position

The Eurozone

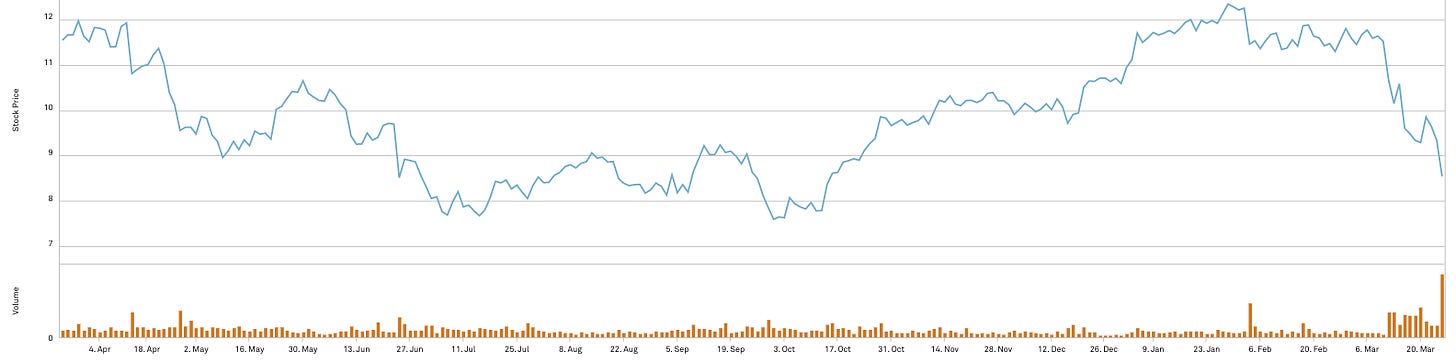

Shorts have also played well, as seen above in the EG chart. Main point here is Lagarde seen as dovish, PMIs weakening alongside overall data. However, we’ve also seen inflation become sticky so that’ll be a key factor in whether they’ll carry on being dovish, or become hawkish.

Talk about the banking crisis man, the EZ are really feeling the pressure. DB, a large German bank, is really feeling the pressure with CDS widening & Stock Price tumbling - how’d the ECB react to this? do they move on like the FED? or do they ‘cut/pause rates’…

Summarised

Trade going well

Econ data supporting us however tough infl

Banking pressure perhaps? key to watch out for

Outro

USD longs terminated, on standby for any significant change in sentiment

GBP longs to be carried on, with more being added

EZ shorts going well, looking to be carried on but unsure whether adding more to pos